Best Crypto Wallet in Argentina 2024-2025

Argentina has rapidly embraced cryptocurrency, driven by economic instability and a weakening national currency. As more Argentinians turn to digital assets like Bitcoin, Ethereum, and stablecoins, having a secure and user-friendly crypto wallet becomes essential. With Argentina’s growing crypto-friendly environment, choosing the best crypto wallet for Argentinian users is more important than ever. This guide will help you compare the top crypto wallets in Argentina for 2024-2025, highlighting their features, security, and usability.

What is Cryptocurrency and a Crypto Wallet?

Cryptocurrency is a decentralized digital currency that operates on blockchain technology. It provides a way to conduct transactions without needing traditional financial institutions. Popular cryptocurrencies in Argentina include Bitcoin, Ethereum, and stablecoins like USDT.

A crypto wallet is an application or device that allows you to store, send, and receive cryptocurrency securely. There are two types of wallets: hot wallets, which are connected to the internet, and cold wallets, which are offline and considered more secure. The first wallets emerged alongside Bitcoin in 2009, offering users a way to manage their digital coins. Since then, crypto wallets have evolved to include multi-currency support, dApps, and DeFi functionalities.

Is Argentina Crypto-Friendly?

Yes, Argentina is becoming increasingly crypto-friendly. Due to the country’s high inflation and unstable peso, many Argentinians turn to cryptocurrency as a more stable store of value. Argentina has even seen the emergence of Bitcoin ATMs and crypto exchange wallets that allow users to buy and sell digital assets conveniently.

Argentina’s government has yet to impose strict regulations on cryptocurrency use, which has made it easier for residents to buy, sell, and store crypto assets. However, there are tax implications for cryptocurrency transactions, and it is essential to use a secure wallet that complies with Argentina’s cryptocurrency regulations.

Top 7 Best Crypto Wallets in Argentina 2024-2025 - Comparison

1. Walletverse

Walletverse is a top choice for Argentinian crypto users due to its intuitive design, security features, and support for over 600 cryptocurrencies. This community-driven wallet is ideal for both beginners and advanced users.

Pros:

- Multi-account support;

- Passcode and biometric authentication;

- Google Pay, Apple Pay, and credit/debit cards for purchasing crypto;

- Supports DeFi and dApps;

- Staking;

- AML.

Cons:

- Only mobile wallet yet.

2. Trust Wallet

Trust Wallet offers seamless interaction with Web3 and DeFi. It’s known for supporting NFTs and offering easy access to DApps.

Pros:

- Supports 140+ cryptocurrencies;

- No personal data is required for the setup;

- Advanced security features like encrypted cloud backup.

Cons:

- Most coins are only supported on mobile;

- Advanced features can be challenging for beginners.

3. Exodus Wallet

Exodus is a non-custodial wallet with support for over 50 blockchain networks. Its multi-platform accessibility allows users to manage crypto on desktop, mobile, or browser extensions, making it versatile for Argentinian users.

Pros:

- Supports multi-chain interactions;

- Built-in exchange and crypto staking;

- Hardware wallet integration with Trezor.

Cons:

- Not open-source, raising concerns about security transparency.

4. MetaMask

MetaMask is a widely used wallet for interacting with Ethereum and other blockchain networks. Known for its strong encryption, MetaMask is a reliable solution for Argentinians looking to manage their crypto securely.

Pros:

- Supports multiple blockchains and hardware wallets;

- DEX aggregator for getting the best swap rates.

Cons:

- Relies heavily on users to safeguard their seed phrases.

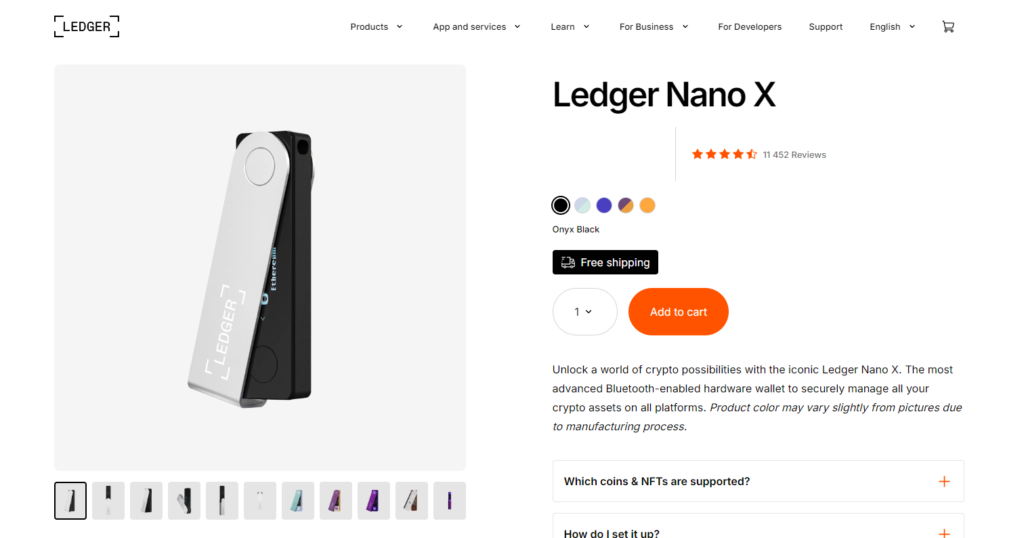

5. Ledger Nano X

The Ledger Nano X is one of the best cold wallets for Argentinian users. Its Bluetooth connectivity and mobile support make it convenient while ensuring top-notch security.

Pros:

- Cold storage for enhanced security;

- Supports over 1,800 coins and tokens;

- Works with mobile devices.

Cons:

- Expensive compared to software wallets.

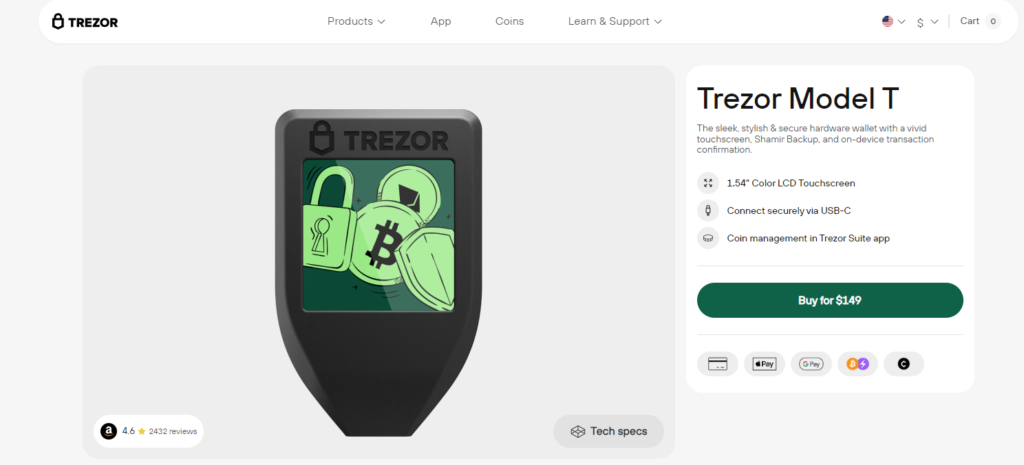

6. Trezor Model T

Like Ledger, the Trezor Model T is a hardware wallet that offers robust security. It supports a wide range of cryptocurrencies and includes a user-friendly touchscreen interface.

Pros:

- Secure cold storage;

- Touchscreen for easy navigation;

- Open-source software for transparency.

Cons:

- Higher cost, especially for casual users.

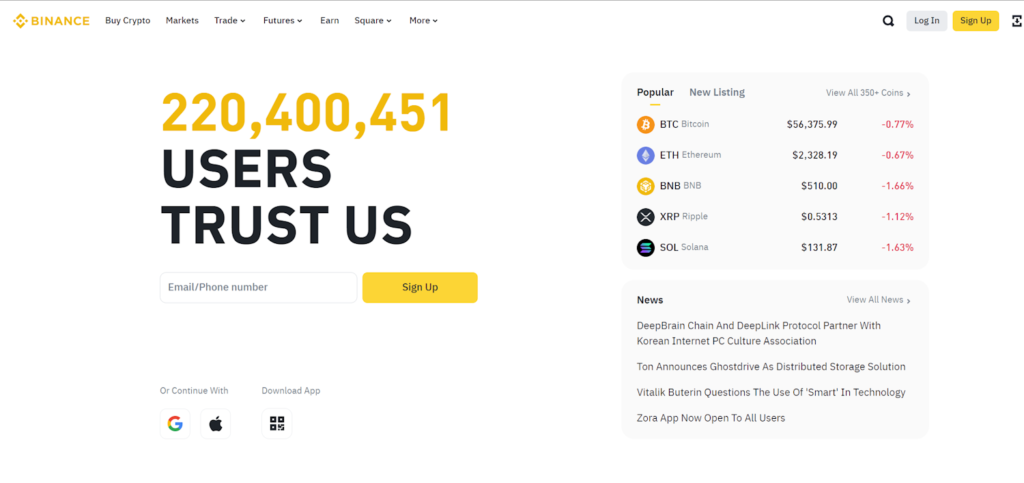

7. Binance

The Binance wallet integrates directly with the world’s largest cryptocurrency exchange, offering users an all-in-one solution for trading, staking, and storing their crypto.

Pros:

- Access to the Binance Exchange;

- Staking, saving, and lending features.

Cons:

- Not ideal for users seeking a non-custodial wallet.

Requirements to Buy Cryptocurrency in Argentina

To buy cryptocurrency in Argentina, you need to meet a few requirements. These are essential for complying with Argentina’s cryptocurrency regulations and ensuring a smooth transaction process:

- Government-issued ID. You will need a valid ID, such as a passport or national ID card, to verify your account on most cryptocurrency platforms. This is required for Know Your Customer (KYC) regulations, which help prevent fraud and ensure compliance with anti-money laundering laws.

- Crypto wallet. Before buying cryptocurrency, you’ll need a secure crypto wallet to store your digital assets. Popular wallets like Walletverse, Trust Wallet, and Exodus are good options. These wallets ensure your cryptocurrency is safely stored after purchase.

- Payment method. In Argentina, you can buy crypto using a credit or debit card, Apple Pay, or Google Pay. Some wallets like Walletverse offer convenient payment options in multiple currencies, including USD, EUR, ARS, and more.

- Stable internet connection. Since the process of buying crypto is entirely digital, you will need a stable Internet connection to complete the transaction on your chosen platform or wallet app.

- Argentina tax regulations. Although Argentina is crypto-friendly, you still need to be aware of potential tax implications. Cryptocurrency transactions may be subject to capital gains taxes, so keeping track of your trading activity and reporting it accurately is essential.

How to Buy Cryptocurrency in Argentina Step by Step

If you’re ready to buy cryptocurrency in Argentina, follow these simple steps:

Step 1: Choose a secure crypto wallet

The first step is to select a reliable crypto wallet where you can store your digital assets. Walletverse is a highly recommended option for Argentinian crypto users as it offers a user-friendly interface, multi-account support, and advanced security features like biometric authentication.

Step 2: Create an account

Once you’ve chosen a wallet, download the app or access the platform via its website. Register for an account and complete the verification process by providing a valid ID for KYC compliance.

Step 3: Add a payment method

Next, add a payment method to fund your account. Walletverse allows you to use Apple Pay, Google Pay, or your credit/debit card. Select the currency you wish to use (USD, EUR, ARS, etc.).

Step 4: Buy cryptocurrency

Once your account is funded, navigate to the “Buy” section in the wallet. Choose the cryptocurrency you want to purchase, such as Bitcoin, Ethereum, or USDT. Enter the amount you want to buy and confirm the transaction.

Step 5: Store your crypto safely

After purchasing, your cryptocurrency will appear in your wallet. Ensure that your wallet is protected by enabling security features like a passcode or biometric authentication to keep your assets safe.

Step 6: Monitor your investment

Regularly check your crypto balance and monitor the market for changes in prices. Wallets like Walletverse provide easy access to your portfolio and make managing your assets convenient.

Popular Crypto Wallets in Argentina

Walletverse, Exodus, Trust Wallet, and MetaMask are among the most popular crypto wallets for residents of Argentina. Each offers unique features to enhance the crypto experience, including ease of use, multi-chain support, and top-notch security.

As Argentina continues to adopt cryptocurrency, choosing the best crypto wallet for

Argentinian users are crucial for safely storing and managing your assets. Whether you prefer a cold wallet for long-term storage or a versatile mobile wallet like Walletverse, there are many excellent options to explore in 2024-2025.

FAQ

Most frequent questions and answers

Several wallets are popular and functional in Argentina, including Walletverse, Exodus, Trust Wallet, and MetaMask. These wallets support a range of cryptocurrencies, have secure storage options, and are compatible with local regulations.

You can easily buy Bitcoin using the Walletverse app. Simply download the app and add a payment method like Google Pay, Apple Pay, or a credit/debit card. After that, you can purchase Bitcoin and securely store it in your Walletverse wallet.

The process of buying USDT (Tether) is similar to buying Bitcoin. Using the Walletverse app, you can fund your account through Google Pay, Apple Pay, or a credit card and buy USDT. The purchased USDT will be stored safely in your wallet.

Yes, Argentina has a growing number of Bitcoin ATMs, especially in major cities like Buenos Aires. These ATMs allow users to purchase Bitcoin using cash or a card and transfer it directly to their crypto wallet.

For Argentinian crypto users, the best Bitcoin wallets include Walletverse, Exodus, Trust Wallet, and Ledger Nano X. These wallets provide excellent security, user-friendly interfaces, and support for multiple cryptocurrencies, including Bitcoin.