What Is a Self-Custody Crypto Wallet?

The global crypto wallet market size was USD 1,470.9 million in 2021, and it is projected to reach USD 25,936.8 million by 2032, growing at a CAGR of 29.81% during the forecast period. As the cryptocurrency landscape continues to expand, understanding the types of wallets available is crucial for both security and asset management. One key option that stands out is the self-custody crypto wallet.

What Is a Self-Custody Crypto Wallet?

A self-custody crypto wallet is designed to provide users with complete control over their digital assets. Unlike custodial wallets, where a centralized entity holds your private keys and manages your funds, a self-custody wallet empowers you to be your own bank. This type of wallet can come in various forms, including software wallets (mobile or desktop apps) and hardware wallets (physical devices).

When using a self-custody wallet, you generate your own private keys, which are crucial for authorizing transactions. This means that no third party can access your funds, giving you full ownership and responsibility. The decentralized nature of self-custody wallets aligns with the core principles of cryptocurrency: autonomy, transparency, and security.

Benefits of Self-Custody Crypto Wallet

In addition to the primary benefits already mentioned, here are more advantages of using a self-custody crypto wallet:

- Flexibility in asset management. Users can easily manage multiple assets without restrictions imposed by a third-party provider, enabling more dynamic portfolio management.

- Enhanced customization. Many self-custody wallets offer advanced features like customizable transaction fees and integrations with decentralized applications (dApps), allowing for a tailored user experience.

- Community support. Many self-custody wallets have strong community backing, providing users with access to resources, tutorials, and forums for assistance.

- Regulatory independence. By managing your own assets, you can operate outside the confines of government regulations that may affect custodial services, offering greater freedom in financial activities.

Why is a Self-Custody Wallet Better Than Others?

Further elaborating on why self-custody wallets are better than custodial options:

- Risk mitigation. With custodial wallets, you are vulnerable to exchange hacks, insolvency, or regulatory crackdowns. Self-custody minimizes these risks, as your funds aren’t stored on potentially insecure servers.

- Full transparency. Users can verify their transactions on the blockchain, ensuring that their funds are handled as intended. This level of transparency is not always available with custodial wallets.

- Immediate access to funds. Since you are not reliant on a third party, you can access your funds anytime without needing permission or experiencing delays.

- Ownership of assets. Self-custody wallets allow users to participate in various activities, such as staking or governance, directly with their assets. This enhances user engagement in the cryptocurrency ecosystem.

Top 5 Best Self-Custody Crypto Wallets

1. Walletverse - Mobile Self-Custody Wallet

- Overview. Walletverse stands out as a user-friendly mobile wallet designed for both beginners and experienced users. It supports over 600 cryptocurrencies and offers a seamless interface for easy navigation.

- Key features. Robust security measures like passcode and biometric authentication, multi-currency support, and built-in purchasing options via Apple Pay, Google Pay, and credit/debit cards.

- Why choose Walletverse? Its community-driven approach, self-custody features, and efficient management of digital assets make it a top choice for crypto enthusiasts.

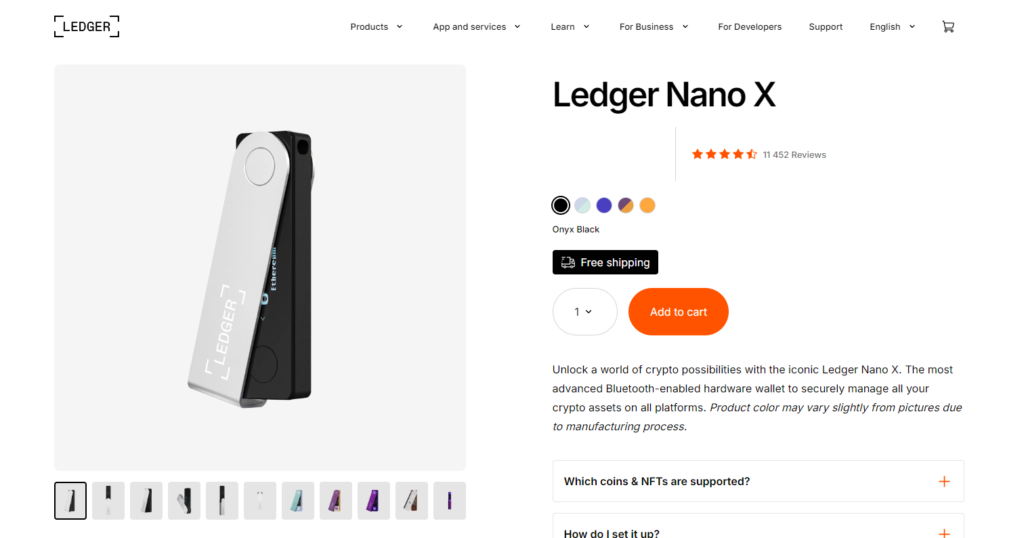

2. Ledger Nano X - Hardware Wallet

- Overview. The Ledger Nano X is a hardware wallet known for its security and offline storage capabilities. It connects via Bluetooth, allowing users to manage their assets on mobile devices easily.

- Key features. It is highly secure with a certified secure chip, supports over 1,800 cryptocurrencies, and features a user-friendly mobile app.

- Why Choose Ledger Nano X? Its portability combined with top-notch security makes it ideal for users who prioritize safety while on the go.

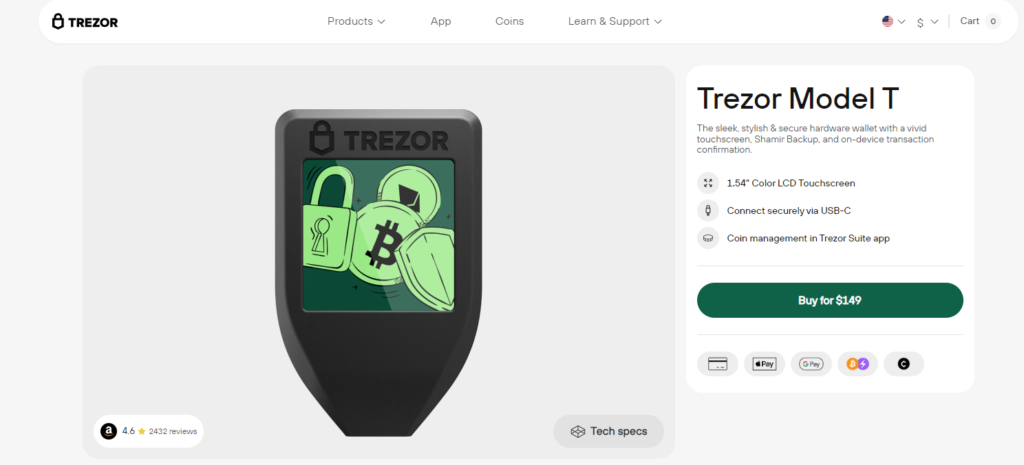

3. Trezor Model T - Hardware Wallet

- Overview. Trezor Model T is another leading hardware wallet that offers a touch-screen interface for easier navigation. It supports a wide range of cryptocurrencies and provides robust security features.

- Key features. Open-source software, advanced security with PIN protection, and support for third-party apps for added functionality.

- Why Choose Trezor Model T? Its reputation for security and ease of use makes it a favorite among serious crypto investors.

4. Exodus

- Overview. Exodus is a software wallet that offers an intuitive interface, making it ideal for beginners. It supports a variety of cryptocurrencies and provides an integrated exchange feature.

- Key features. Built-in exchange, user-friendly design, and 24/7 customer support. It also offers portfolio tracking features.

- Why Choose Exodus? Its combination of accessibility and functionality makes it a great starting point for newcomers to the crypto world.

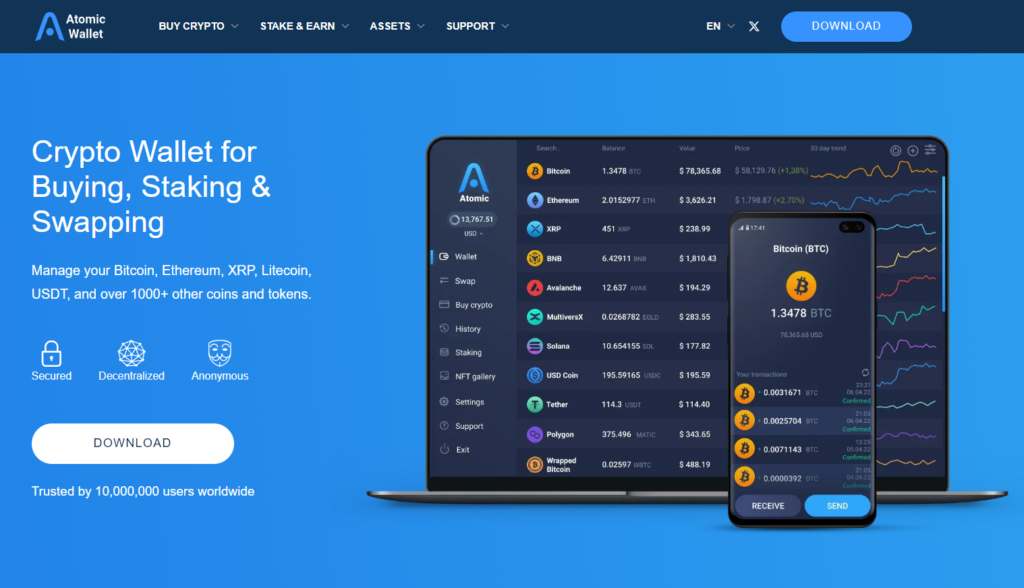

5. Atomic Wallet

- Overview. Atomic Wallet is a decentralized wallet that supports over 500 cryptocurrencies. It allows users to manage, exchange, and stake their assets easily.

- Key features. Built-in Atomic Swap technology for peer-to-peer exchanges, security through private key storage on the user’s device, and a strong focus on privacy.

- Why Choose an Atomic Wallet? Its robust features and support for a wide range of cryptocurrencies make it suitable for users looking for a comprehensive self-custody solution.

These self-custody wallets cater to various user needs, from security to usability. Choosing the right one depends on individual preferences and requirements, ensuring that you can manage your digital assets effectively while retaining full control.

What Should a Self-Custody Wallet Be Able to Do?

A self-custody wallet should encompass a variety of essential features to ensure a seamless and secure user experience. Here are additional capabilities that a self-custody wallet should have:

- Multi-signature support. Advanced security can be achieved through multi-signature functionality, requiring multiple private keys to authorize a transaction. This adds an extra layer of protection against unauthorized access.

- Cross-platform compatibility. A robust self-custody wallet should be accessible across different devices (mobile, desktop, hardware), enabling users to manage their assets conveniently regardless of their preferred platform.

- Built-in exchange features. Integrated swapping or exchange capabilities allow users to trade cryptocurrencies directly within the wallet without needing to transfer funds to an external exchange. This improves efficiency and reduces transaction fees.

- Backup and recovery options. The wallet should provide clear instructions for securely backing up your recovery phrase and restoring access to your funds. A user-friendly backup process is crucial for ensuring that assets can be recovered in case of device loss.

- Privacy features. An ideal self-custody wallet should prioritize user privacy, allowing for anonymous transactions or features like coin mixing to obscure transaction history.

- Support for decentralized applications (dApps). Integration with dApps enhances functionality, enabling users to engage with various DeFi platforms, NFT marketplaces, and other blockchain services directly from their wallets.

- Regular software updates. Continuous updates are vital for maintaining security and compatibility with evolving blockchain protocols. The wallet should have a reliable system for rolling out updates.

- User education resources. A self-custody wallet should offer educational resources, tutorials, or community support to help users understand the nuances of self-custody and best practices for security.

- Transaction customization. Users should be able to customize transaction fees based on their urgency, allowing for quicker transactions during peak network times.

- Alerts and notifications. Real-time alerts for incoming and outgoing transactions can help users monitor their wallets and quickly identify any unauthorized activity.

Understanding what a self-custody crypto wallet is and its benefits can greatly enhance your experience in the cryptocurrency space. With tools like Walletverse, you can manage your assets securely and confidently, ensuring your financial sovereignty in the ever-evolving world of crypto.

FAQ

Most frequent questions and answers

A self-custody wallet works by allowing users to generate and manage their private keys. Users have full control over their funds and can send or receive cryptocurrency without relying on a third party.

While self-custody wallets are generally more secure than custodial wallets, they can still be vulnerable to hacks if users do not take proper precautions. Keeping software updated and using strong passwords can mitigate these risks.

To use a self-custody wallet, download the wallet app, create a new wallet, and securely back up your recovery phrase. From there, you can send and receive cryptocurrencies by entering wallet addresses and managing your assets directly.

Self-custodial wallets allow users to hold and control their private keys. In contrast, non-custodial wallets typically mean that a third party holds the keys on your behalf, which can limit your control over your assets.