What is a Crypto Wallet? Ultimate Guide for Beginners and Advanced

The global crypto wallet market is rapidly expanding, estimated at USD 8.42 billion in 2022. It is expected to grow at a compound annual growth rate (CAGR) of 24.8% from 2023 to 2030. As more individuals and businesses adopt cryptocurrency, cryptocurrency wallets are crucial in securing digital assets. But what exactly is a crypto wallet, and how does it work?

What is a Crypto Wallet?

A crypto wallet is a software program or hardware device that stores private and public keys and interacts with blockchain networks to enable users to send, receive, and manage cryptocurrencies. While many people compare it to a traditional wallet, a crypto wallet doesn’t store currency. Instead, it secures access to your digital assets on the blockchain. The rise of Bitcoin in 2009 led to the development of digital wallets to store and manage these new forms of currency.

Key Terms in Crypto Wallets:

- Private and public keys in crypto wallets. Private keys are like passwords, providing access to your assets. Public keys are like your bank account number—what you share to receive funds.

- Non-custodial crypto wallet. A type of wallet where only you control the private keys, giving you full ownership of your assets.

- Multi-currency crypto wallet. A wallet that supports multiple types of cryptocurrencies, like Bitcoin, Ethereum, and Tether.

- Cold vs. hot crypto wallets. Cold wallets are offline storage, while hot wallets are connected to the internet, providing easier access but less security.

How Does a Crypto Wallet Work?

A crypto wallet doesn’t hold the physical coins but manages the private and public keys that give users access to their digital assets on the blockchain. Here’s how it works in a simplified process:

- Private and public keys. Every crypto wallet has two types of keys. The private key is like a password that proves crypto ownership and allows the user to send it. The public key is like a bank account number that people use to send crypto to you. When you generate a transaction, your wallet uses your private key to sign and authorize it on the blockchain.

- Blockchain interaction. When you send or receive crypto, the wallet interacts with the blockchain to update the ledger and record the transaction. The blockchain is a decentralized database that tracks all cryptocurrency transactions and ownership.

- Secure storage for cryptocurrencies. The crypto wallet doesn’t store the actual currency but secures the private keys, granting access to your blockchain funds. Without these keys, you cannot access or manage your cryptocurrency.

- Types of transactions:

- Sending crypto. When sending, your wallet signs the transaction using your private key, broadcasting it to the blockchain network for confirmation.

- Receiving crypto. When receiving funds, you share your public key (or wallet address) with the sender, and the blockchain records the transaction to your account.

- Non-custodial vs. custodial. In a non-custodial crypto wallet, the user holds the private key and fully controls their assets. In a custodial wallet, a third party, such as an exchange, holds the private key and manages the security of the user’s funds.

Crypto Wallet Types

Several types of crypto wallets offer varying levels of security, convenience, and functionality. Here’s a detailed breakdown of the main wallet types:

Hot Wallets

Hot wallets are always connected to the internet, making them accessible and convenient for day-to-day transactions. They are often used for quick transfers and exchanges.

- Pros:

- Instant access to your funds

- Easy to use for frequent transactions

- Cons:

- More vulnerable to hacking due to constant internet connection

Cold Wallets

Cold wallets are offline wallets used for the long-term storage of cryptocurrencies. Because they’re not connected to the internet, they provide better security.

- Pros:

- Highly secure, as they are not vulnerable to online hacks

- Ideal for holding large amounts of crypto for extended periods

- Cons:

- Less convenient for daily transactions

- Accessing funds requires connecting the wallet to a device

Hardware Wallets

Hardware wallets are physical devices (similar to USB drives) that store private keys offline. They are a cold wallet type and are considered one of the safest options for securing crypto.

- Pros:

- Extreme security due to offline storage

- Resistant to viruses or malware

- Cons:

- Costs more than software wallets

- Requires physical access to transfer assets

Software Wallets

Software wallets are applications or programs that store and manage crypto keys on your device (mobile, desktop, or browser). They are usually connected to the internet and fall under the hot wallet category.

- Pros:

- Free or low-cost

- Convenient for daily use and accessible on multiple devices

- Cons:

- Security depends on the strength of your device’s protection (e.g., antivirus, firewall)

- Vulnerable to hacking or malware

Mobile Wallets

Mobile wallets are a type of software wallet specifically designed for smartphones, making them easy to use on the go. Examples include Walletverse, Trust Wallet, and Coinbase Wallet.

- Pros:

- Easy to use, portable, and accessible from anywhere

- Often have built-in features like QR code scanning for transactions

- Cons:

- Security depends on the phone’s security (e.g., passcodes, biometric protection)

- Vulnerable to mobile malware or phishing attacks

Desktop Wallets

Desktop wallets are software wallets installed on a desktop or laptop. They provide a good balance of security and convenience for users who prefer to manage their crypto from their computers.

- Pros:

- More secure than web-based wallets

- Access to advanced features, like node connections and trading tools

- Cons:

- Vulnerable to computer viruses and malware

- Not as convenient for on-the-go transactions

Custodial Wallets

Custodial wallets are managed by third parties, such as exchanges. The third party holds your private keys and manages your security, meaning you rely on their security infrastructure.

- Pros:

- Easy for beginners, as the platform handles security and transactions

- No need to worry about losing private keys

- Cons:

- Users do not have complete control over their funds

- Vulnerable to hacks and breaches on the platform

Each type of wallet serves different purposes, and choosing the right one depends on whether you prioritize security, accessibility, or ease of use. Walletverse is an excellent option for users seeking a multi-currency crypto wallet that balances convenience and security. However, a hardware wallet might be preferable for long-term storage for its offline security.

Which Crypto Wallet Is Best? - Comparison

Choosing the best crypto wallet depends on your needs. Let’s compare Walletverse with other popular options:

1. Walletverse

Walletverse is a mobile-first DeFi crypto wallet designed for beginners and advanced users. It offers a user-friendly interface with support for over 600 cryptocurrencies, making it one of the most versatile wallets. It provides seamless integration with Apple Pay, Google Pay, and traditional credit/debit cards, allowing users to easily buy crypto through the app.

Pros:

- Supports 600+ cryptocurrencies;

- Biometric authentication and passcode protection for security;

- Features like multi-account support and DEX aggregator;

- User-friendly, with a fast app and community-driven wallet features;

- Gamification through NFT Hamsters offers up to 70% discount on transaction fees.

Cons:

- Mobile only wallet.

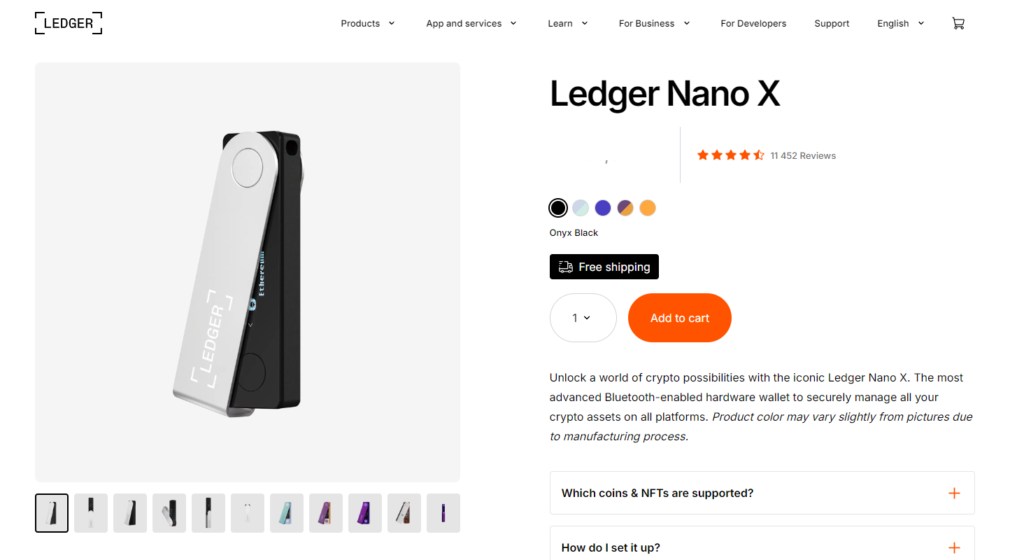

2. Ledger Nano X

The Ledger Nano X is one of the most well-known hardware wallets, providing offline, cold storage for cryptocurrencies. It supports various digital assets and offers Bluetooth connectivity, making it more convenient than other hardware wallets.

Pros:

- Highly secure with cold storage and offline access;

- Supports over 1,800 cryptocurrencies;

- Bluetooth capability for mobile use.

Cons:

- Expensive compared to other wallet options;

- Not ideal for frequent transactions due to its cold storage nature.

3. Trust Wallet

Trust Wallet is a mobile crypto wallet with a simple and intuitive interface. It supports multiple cryptocurrencies and includes features like dApps and staking, making it a popular choice for users looking for more than just storage.

Pros:

- Supports a wide range of cryptocurrencies;

- Built-in access to dApps and staking opportunities;

- Free and easy to use for beginners.

Cons:

- Security features are not as advanced as hardware wallets;

- Users must rely on the security of their mobile devices.

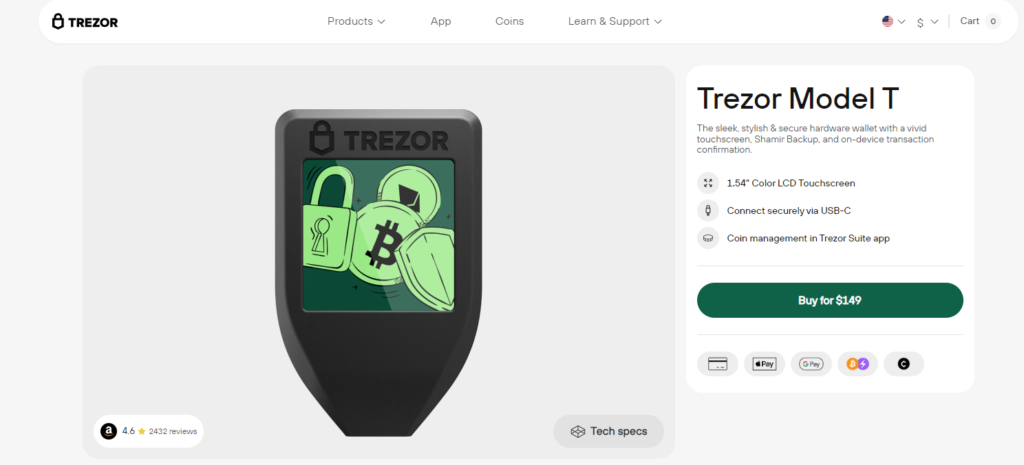

4. Trezor Model T

The Trezor Model T is another popular hardware wallet known for its cold storage capabilities. It supports a large number of cryptocurrencies and provides robust security for long-term storage of digital assets.

Pros:

- Offers cold storage with high levels of security;

- Easy-to-use touchscreen interface;

- Supports over 1,000 cryptocurrencies.

Cons:

- Not convenient for daily transactions due to the need for connecting to external devices;

- Higher cost compared to software wallets.

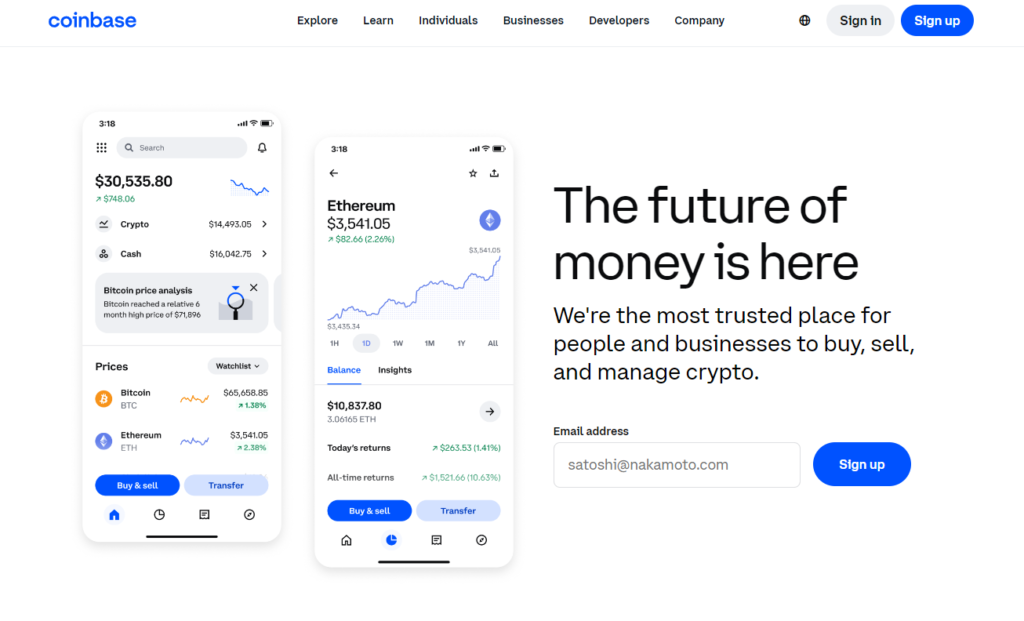

5. Coinbase Wallet

Coinbase Wallet is a non-custodial wallet linked to the popular Coinbase exchange. It’s a great choice for beginners and users of the Coinbase platform, offering seamless integration for trading and transferring assets.

Pros:

- Easily integrates with the Coinbase exchange for quick transfers;

- Suitable for beginners who are already familiar with the Coinbase platform;

- Free to use and supports multiple cryptocurrencies.

Cons:

- Custodial wallet if used within the Coinbase exchange, meaning you don’t fully control the private keys;

- Less secure than hardware wallets.

How to Protect Your Cryptocurrency Wallet

Security is a top priority when it comes to storing digital assets. Here are some ways to ensure your cryptocurrency wallet is secure:

- Use a non-custodial wallet. Ensure you have control over your private keys. Walletverse offers this level of security.

- Enable biometric and passcode authentication. Many wallets, including Walletverse, offer biometric authentication and passcode protection to enhance security.

- Cold vs. hot wallets. Use a cold wallet for long-term storage of large amounts of cryptocurrency.

- Backup your private keys. Always store your private keys securely, such as a physical backup or encrypted device.

The crypto wallet market is growing rapidly, projected to reach USD 56.7 billion by 2024. As cryptocurrency adoption continues, wallets like Walletverse are at the forefront of providing secure, easy-to-use platforms for beginners and advanced users alike. Whether looking for a simple way to buy, store, or send cryptocurrency, having the right wallet is essential.

FAQ

Most frequent questions and answers

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies, it operates on decentralized networks using blockchain technology. This means no central authority, like a bank, controls or issues the currency. Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), which can be used for various purposes, such as purchasing goods, trading, or investing.

People store their crypto in wallets to securely manage their private keys, which are required to access their digital assets on the blockchain. A wallet ensures secure storage for cryptocurrencies, protecting them from hackers and unauthorized access. Whether using a cold wallet for long-term storage or a hot wallet for frequent transactions, wallets provide an essential layer of security for your funds.

Yes, a crypto wallet is essential if you want to take complete control of your digital assets. While you can leave your funds on an exchange, it exposes them to higher risks, such as hacks or platform failures. A non-custodial crypto wallet gives you full ownership of your private keys and provides greater security. Additionally, wallets like Walletverse offer features like multi-account support and enhanced security to keep your assets safe.

A crypto wallet doesn’t hold physical money but stores the keys to your digital assets. The value in your wallet represents cryptocurrencies, which can be used to trade, invest, or purchase goods and services. While it’s not traditional cash, cryptocurrencies like Bitcoin and Ethereum have real-world value, and many businesses accept them as payment. So, while it’s not the same as physical money, it is a digital currency that can be used similarly.